Buying a Home Can Be Simpler Than You Think!

Apply Now with Cristian Beltran, Your Expert Loan Officer

Your Friendly Guide to Purchasing a Home

Who we are

Reasons Why Homeownership Is a Good Financial Investment

Taking the leap into homeownership can be daunting when you’re used to renting. From house hunting to making an offer to gathering pertinent paperwork, it’s a much more complex process than signing a lease agreement. While quicker financial approval and less responsibility make renting attractive, the numbers suggest becoming a homeowner could be better for your overall financial picture. According to a 2022 Rental Affordability Report, owning a median-priced, three-bedroom home is more affordable than renting a three-bedroom property in 666, or 58%, of the 1,154 counties analyzed for the report.

- Building equity over time

- Keeping monthly payments stable

- Tax advantages

- Pride in ownership

- Sense of community

-RALPH MCLAUGHLIN, TRULIA'S CHIEF ECONOMIST

Reasons to Buy a Home Now

Forecasts predict a small but positive year-over-year growth for the remaining 2022 housing market. Locking in a home this year could still save you a substantial amount over time.

Rest assured in having some of the most competitive rates in the market to put you in the best financial situation in any market.

Your mortgage payment allows you to build equity ownership interest in your home. Many consider paying down their house as a forced savings plan, which could be extremely useful when you're ready to retire.

Homeowners are able to deduct the interest on their mortgage, property taxes, and other costs involved with owning a home. That's something a renter cannot leverage.

Owning a home shields you from rent increases, many pet restrictions and most parameters on how you can decorate. You have the freedom to make many improvements that suit your taste and lifestyle. loanDepot offers a variety of home renovation loans to make your dream come to life.

Homebuying Myths

More than 6 in 10 Americans falsely believe you must put at least 20% down in order to purchase a home. While it's best to strive toward 20% down, that may not be a feasible objective for all homebuyers. According to census data, 1 in 3 (32%) current U.S. homeowners put down just 5% on their home. For those who qualify, loanDepot offers home financing with as little as 3.5% down.

When choosing between a 15- or 30-year mortgage, a 30-year may not always be your best option. While the loans are structured similarly, it all comes down to the length of the loan. If you don't mind the higher monthly payments associated with a 15-year term loan, you can accumulate equity in your home at a much faster pace than the 30-year term and save substantially on interest over the life of the loan.

Many Americans believe that good credit starts in the 700s, but the truth is that your requisite credit score really depends on the type of home loan you qualify for. There are a number of programs that allow credit scores starting at low 600s.

Factors

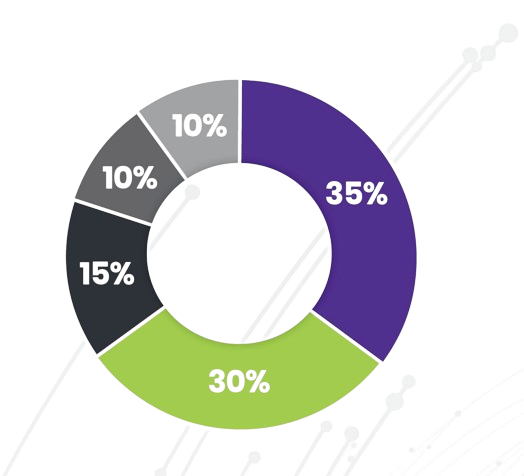

5 Factors That Make Up Your Credit Score

loanDepot's Mortgage Menu

Conventional loans are the most common type of mortgage. They are best for borrowers with strong credit scores and a stable income.

- Attractive interest rates and lower costs for those who qualify

- No PMI with 20% down

- Down payment as low as 3%

- Can be used for second homes and investment properties

- Broken down into "conforming" and "non-conforming"

FHA loans are suitable for first-time homebuyers as well as buyers with low credit scores. They're typically a more affordable, government-backed financing option.

- Credit score as low as 520

- Down payment as low as 3.5%

- 1-4 unit owner- occupied residences

- Can be used for purchase, rate/term refinance, and cash- out refinance

- Both fixed and adjustable types

VA loans are primarily for active-duty military service members, veterans, and surviving military spouses.

- No down payment

- Flexible interest rates

- No PMI

- Both fixed and adjustable types

- Limits on closing costs

- Penalty-free pre-payment

203k loans are used for doing renovations or repairs on a home. FHA 203k Limited loans are used to finance non-structural repairs under $35,000, while FHA 203k Standard loans are used to finance major remodels in excess of $35,000

- Down payment as low as 3.5%

- Both fixed and adjustable types

- Minimum credit score of 580

- No minimum renovation cost

- Allowed on 1-4 unit properties

Jumbo loans are larger than the conforming limits on conventional loans. These are best for those looking for luxury homes or residences in high-cost markets.

- Down payment as low as 5%

- No mortgage insurance

- Loan amounts up to $3 million

- Both fixed and adjustable types

- USDA - Rural loans 0% down

- Non QM mortgage option which allows us to use non traditional forms of income through 12 or 24 bank statements, 1 year of tax returns

- DSCR - Debt Service Coverage Ratio investor loans starting at 20% down

Buy a Home with as Low as 0% Down with an FHA Loan

Tips and tricks

Tips for Making a Successful Offer

Being well prepared to make a solid offer when the perfect home comes along is key to realizing your homeownership dream. Here are some tips to ensure you get the competitive edge when making a purchase offer on a home:

It's crucial to take this step before you even consider making an offer since being pre-approved assures the seller that you are a serious buyer and have access to financing, loanDepot's mello smartloan™ allows you to digitally connect your income, employment and assets for a swift and secure data verification process.

The inventory of starter homes listed for sale has remained relatively low with buyer demand continuing to out- pace the supply of homes for sale. This of course causes buyers to compete with each other for their dream home, so make certain you move as quickly as possible with presenting your offer to the sellers. It's not uncommon for homes to sell above the list price in competitive markets

Put down a healthy earnest money deposit A larger earnest money deposit shows you are serious and willing to put your cash on the table. Sellers may feel you are more committed to follow-through with a 3% deposit versus a 1% deposit. This serves as an assurance that you'll be less likely to walk away from the deal

You and your real estate agent can determine an offer that shows you're serious but also willing to negotiate. Offers will likely be comparable with other sales and listings in the neighborhood.

Why a Pre-Approval Should Be Your First Step

What is a pre-approval?

Before you go any further, it’s important to get pre-approved. Getting pre-approved for a loan means that you know how much money a lender is willing to give you, at what rate, and on what terms. Pre-approval involves submitting a preliminary application to a lender that will then review your credit, your income and other factors, and tell you what loans are available to you. loanDepot’s mello smartloan™ allows you to skip the paper-chase by digitally connecting your income, employment and assets** – making it one of the most swiftest and secure data verification process you’ll ever experience

Our Value

Simple. Secure. Smart.

Mello smartloan™ virtually eliminates all of the legwork and stress currently associated with obtaining amortgage, enabling you to stay competitive in today’s market. Within minutes of submitting your application, mello smartloan™ will identify the loan that will provide you with the optimal cost- and/or time- savings. With mello smartloan™, you can expect more certainty when it comes to closing on your home.

Our process

Simple Guide

First, we gather some of your basic contact information.

Then, rather than asking you to find paper files, we digitally collect income, employment and asset information.

In minutes, we can share with you just how much you may be able to save in time and/or money on your loan.

Testimonial

Client Feedback

-

To say that I have been working with Cristan Beltran for a few years now, and Cristian always goes above and beyond, an understatement! Beltran literally goes into detail... read more on every single question any buyer has about a loan. The process is always truly simplified with him. He walks buyers through everything with patience and professionalism. Buyers are always happy with his services and talk about doing future business with him as they know that he will get them to their desired goal and will work with them every step along the way, as home buyers. Rules and regulations are changing, and Cristian is always on top of everything. He is well prepared to answer any questions. Cristian has the knowledge and knows exactly what clients need and always has their best interest in mind.

lucy chavez

Gracias a IoanDepor por contar con excelentes profesionales y capacitados para estos grandes proyectos . En especial a Cristian Beltrán por hacer posible este sueño.

Angela Ramirez

Exelente

Ana camila Galvan leon

-

Excellent people to work with and provide great service!

leonor alvarez

Awesome work! Very satisfied!

Salvador Alvarez

Great experience! Anytime you call they answer and are happy to help with any questions. 100% Recommended

Erick Gutierrez

-

Highly recommend Cristian Beltran and his team at loanDepot for their dedication and exceptional service. They genuinely invest time in understanding their clients unique needs and are always readily available... read more to answer questions. If you’re looking for a reliable mortgage lender, rest assured you’re in good hands as they will go above and beyond to meet your needs.

Mauricio Rios

Gracias muy atentó y responsable en su trabajo muchas gracias y nos dio mucha confianza trabajar con usted muchas gracias

Alberto Santos

I cannot express enough how impressed I am with the exceptional service Cristian provides to my clients. As a real estate broker, it is crucial to have a loan officer... read more who knows his job and who guide home buyers with the correct programs. Having Cristian as my prefer lender is paramount in negotiating and getting my client's offers accepted. Cristian has extensive experience, at the same time is very professional and most importantly very responsive.

FRANCIS VASQUEZ

-

Words on a Google review is an extreme understatement for the level of appreciation and respect I have towards Cristian as a person alone. On the business end of things,... read more Cristian is highly competent and knowledgeable at what he does for a living. Obviously, getting approved for a home loan is a personalized process for everyone, and the multi-unit I wanted seemed very well out of reach for me at first; however, with patients he made it happen. I’m certain I wouldn’t of had the same outcome with another MLO, and I am very grateful. If you want a professional, attentive, and mindful home buying/refinancing experience call Cristian. #bestinchicago

Uriel Oropeza

Cristian Beltran and his team are amazing! I decided to refinance my home and with no hesitation at all I called him. Thank you so much for making the process... read more so smooth.

Yazmin Ortega

I always have a phenomenal experience with Cristian and his team. The process is always seamless, transparent and efficient. I highly recommend their services for anyone seeking top-notch real... read more estate lender.

Nancy Granados

About

Meet Cristian Beltran, Your Trusted Loan Officer at loanDepot

Cristian decided to get into the mortgage business because he was looking for both a change in his routine and a job that would challenge him. After ten years in the industry, his favorite part of his job is all the people he both works with and gets to meet every day.

Are you a first-time homebuyer, an investor, or someone interested in qualifying for down payment assistance or grants? You’re in the right place. Cristian Beltran, with many years of experience at loanDepot (NMLS#174457), is here to guide you through every step of your mortgage journey.

- 10 Years of Experience

- Tailored Solutions for Every Buyer

- Down Payment Assistance and Grants

- Comprehensive Mortgage Product Knowledge

- Commitment to Client Success

Start Your Homeownership Journey Today with Cristian Beltran!

Cristian Beltran

Branch Manager

NMLS#1499533

Contact Info

Address

3240 W Fullerton Ave Chicago IL 60647

Phone

Cell: (773) 289-2881

office: (630) 919-7138

Email Address

cbeltran@loandepot.com

Website

www.loandepot.com/loan-officers/cbeltran